Buying a home is a huge investment, making it one of the most important decisions you will make in your life. If you’re a first-time homebuyer, you might be wondering what is required of you to successfully go through to such an endeavor.

On the other hand, buying a house without a Realtor can even be more stressful, especially if you are not sure what and how to do it step by step. It is imperative to be financially and emotionally prepared for the responsibilities that come with homeownership.

Wouldn’t it be great if there is a checklist for buying a home? If you have the appropriate checklist and are guided appropriately, this process can be streamlined and fruitful. With proper guidance from the experts in the real estate field, purchasing a home does not have to be an extremely challenging venture after all.

To assist you in navigating the process of purchasing a home, we, at The Reese Experience, have put together the first time home buyer checklist for your house-hunting needs. This is to also ensure that you are making an intelligent investment in your future for you and your family.

What Do I Need for My First House?

Purchasing a home is a long-term commitment that necessitates considerable planning and thought. It is critical to put your ducks in a row before taking the plunge to this whole process of becoming a new homeowner.

As a first-time home buyer, try considering the following points:

- Determine the size of the house you can afford: To calculate how much you can afford to spend on a home, use a mortgage affordability calculator.

- Get pre-approved for a mortgage: Before you start property looking, look for a mortgage provider and get pre-approved for a mortgage.

- Work with a lender to determine what first-time home buyer down payment assistance programs you may be eligible for. In Charlotte, North Carolina, the North Carolina Housing Financing Agency and DreamKey Partners programs offer assistance towards downpayment and closing costs.

- Save for a down payment: A down payment of at least 3 – 3.5% of the home’s purchasing price is recommended. If you are unable to save so much, you may be required to pay for private mortgage insurance. (PMI).

- Save for the closing costs: Closing cost range from 2 – 3% of the home’s purchase price. Closing costs include loan origination fees, appraisal fees, title searches and attorney fees.

- Work with a competent real estate agent to assist you find the ideal home within your price range.

- Hire a professional home inspector to assess the condition of the house and identify any potential problems.

Common Questions to Ask Yourself before Buying a Home

Purchasing a home is a long-term commitment that necessitates considerable planning and thought. Minus the stress, buying your first home can be an enjoyable experience because it denotes independence and security.

Before you begin the home-buying process, consider the following critical questions:

- How long do I intend to stay at the house?

- How much money can I put down on a house?

- What are my house essentials?

- What are my must-haves in a house?

- If I am considering face to face work, are there any nearby establishments, offices, and employers that can be my potential source of income?

- What are the local schools like?

- What are the transit and roads like?

- What are the crime rates like?

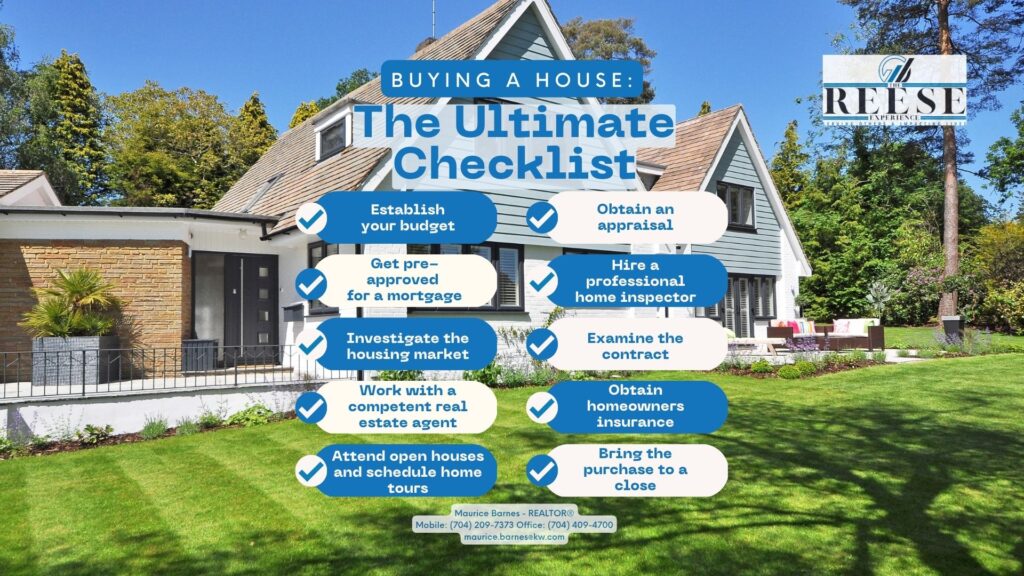

Buying A House: The Ultimate Checklist

Let’s talk about what you’ll need for your first home before we go into the checklist. You’ll need solid credit, a consistent source of income, and money for a down payment and other fees associated with closing. Getting pre-approved for a mortgage will help you figure out how much house you can afford.

Get your pen and be prepared to check these things before buying a house. Here’s the ultimate house-buying checklist:

- Establish your budget: Examine your finances to see how much house you can afford. Typically between the range of 28% – 36% of gross monthly income

- Get pre-approved for a mortgage: Before you start property looking, look for a mortgage provider and get pre-approved for a mortgage.

- Investigate the housing market: Investigate the housing market in the area of interest to obtain a sense of what’s available and the prices.

- Work with a competent real estate agent to assist you find the ideal home within your price range.

- Begin looking for a home by attending open houses and scheduling home tours.

- Obtain an appraisal: Have the home’s value determined by a professional appraiser.

- Obtain a Home Inspection Right Away: The process of purchasing a property should never begin without first conducting a home inspection. It has the ability to show potential issues with the house that might not be obvious to someone looking at it for the first time. Hire a professional home inspector to assess the condition of the house and identify any potential problems. Before finalizing the transaction on the property, it is in your best interest to have it properly inspected by a qualified home inspector who you have hired for issues such as the structural integrity, pest problems such as hornets and termites, source of heating, and others.

- Examine the contract: Before signing, go over the contract and make sure you understand all of the terms and conditions.

- Obtain homeowners insurance: Purchase homeowners insurance to protect your investment.

- Bring the purchase to a close: Once the contract has been signed, pay the closing costs and take ownership of the home. After you have finished all of the required stages, it is time to put the finishing touches on the transaction. This requires the signature of the relevant documents, as well as the payment of the closing costs and the transfer of ownership of the property. You should be congratulated on becoming a homeowner.

Frequently Asked Questions:

Here are some frequently asked questions concerning home buying:

How much money should I save before buying a house?

Set aside funds for a down payment of at least 3 – 3.5% of the home’s purchasing price is advised as to how much money you should put aside before purchasing a home. This will save you money on PMI. Additionally, you need to ensure that you have sufficient funds saved for the closing charges, which can range from 2% to 3% of the purchase price.

What makes a house the most valuable?

To answer this question, you need to establish what factors influence the value of a home? Location, size, condition, age, and upgrades are all aspects that might influence a home’s worth. Among these factors, what is the most important to you?

A home in a desired location, with adequate space, that is in good condition, and that includes desirable features, such as an upgraded kitchen or bathrooms, can potentially be worth more money.

Moreover, take into consideration the local community as well as the surrounding area. When searching for a new home, the neighborhood in which it is located and the surrounding environment are two factors that should be given significant consideration. Drive around the area to look for amenities like grocery stores, restaurants, and parks. This can be done by taking a drive around the neighborhood.

Do some research on the school district and the crime statistics in the neighborhood. Talk to the people that live nearby and get a sense of the neighborhood if at all feasible.

What to look for when doing a house walkthrough?

When performing a walkthrough of a house, you should be on the lookout for evidence of damage or wear and tear. Are there cracks in the walls? Is there water damage? Are there outdated fixtures?

Make sure there is adequate space for storage and that there is plenty of natural light.

Also, make sure to pay attention to the layout of the home and how well it fits your lifestyle before purchasing it.

In summary, first-time home buyers may feel apprehensive about the process. It’s easy to feel overwhelmed by the sheer number of factors to take into account.

Before you go out and buy a house, there are a few vital things you need to ask yourself. Can you describe your ideal features and non-negotiables? In which areas are you most interested in living? What kind of house are you looking for? How much of a budget do you have for a home? For how long do you see yourself residing here?

A down payment of at least 3 – 3.5% of the home’s purchase price is advised, plus an extra 2-3% for closing fees, to address some frequently asked questions concerning home buying. A home’s worth can be affected by its location, current condition, and overall size. All appliances and fixtures should be in good functioning order, and indicators of pest infestation should be looked for during a home inspection.

Now, let’s get down to business with the complete house-buying checklist. Get pre-approved for a mortgage after you’ve established a reasonable spending plan. Then, begin your search for a house in your area of choice. Get an inspection done by a professional. Obtain homeowners insurance and consult legal counsel. The last step before closing is to schedule a walkthrough and final inspection.

Like what you have just read? Maurice Barnes can provide you comprehensive and expert advice on what are the best home deals around Charlotte, NC.