Do you have the Right Foundation to be a Real Estate Investor?

CTN – Criteria, Terms, Network – is referred to as the Dynamic Trio of Investing and is the best way for investors to stay focused:

Defines what you buy and is a foundational piece of your investment strategy that isn’t open for negotiation. Criteria acts as an opportunity filter to identify the potential property purchases that offer the greatest opportunity and the least risk. Ultimately, criteria are used to identify properties with predictable value based on your investment style and strategy.

Define how you turn the prospective property that matches your criteria into a deal. Terms include negotiable factors such as offer price, down payment and interest rate, conveyance, occupancy and possession, and closing costs. When negotiating terms, it’s critical to remember that buying right means getting the right terms, because money is made in real estate going into the deal, not going out.

Your network is made up of the people who help you locate the right deals and get them done. Many people mistakenly believe in the myth of the “Lone Wolf” investor, the entrepreneur who beats out other investors for deals. However, when Keller was researching material for The Millionaire Real Estate Investor, he found time and time again that the best real estate investors leveraged their relationships with people to send them opportunities, for mentoring, and for buying and maintaining properties.

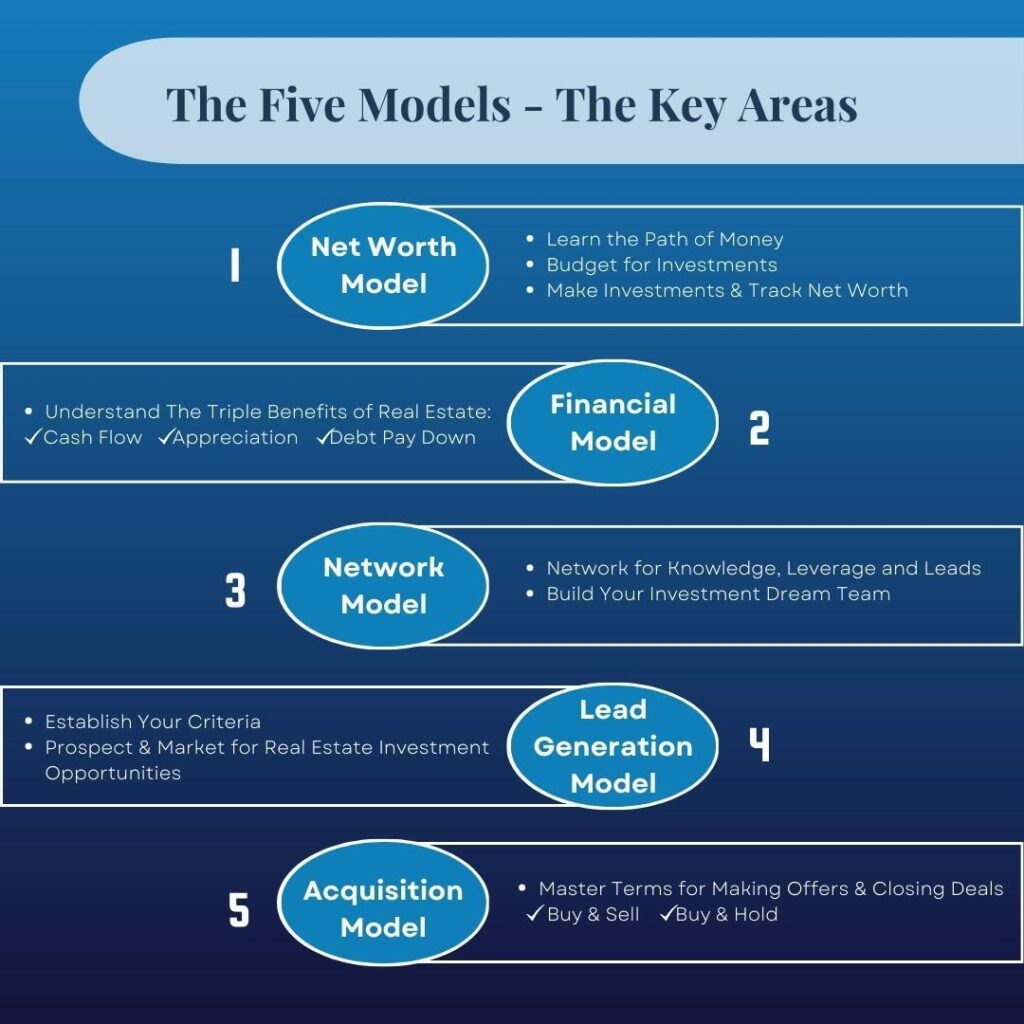

Money is made in real estate at the time the property is bought, not when it’s sold. The five models in this section – Net Worth, Financial, Network, Lead Generation, and Acquisition – are all proven models that let you learn from the mistakes of others:

- Net Worth Model shows that you must guide money along the path to the place that yields the greatest financial growth and net worth.

- Financial Model is comprised of Equity Buildup that increases your net worth through price appreciation combined with debt paydown, while Cash Flow Growth provides a steady stream of passive income.

- Network Model describes how to build your dream team with trusted members from your inner circle of mentors and partners, your support circle of professionals such as attorneys and real estate agents, and your service circle of people who perform property-specific tasks such as contractors or escrow officers.

- Lead Generation Model is used to generate an abundance of leads for investment properties and is building around the four core questions of: What am I looking for, Who can help me find it, How will I find the property or the people connected to it, and Which properties are the real opportunities?

- Acquisition Model focuses on buying right – and making your money going into the deal – and notes that Buy and Hold is the true financial wealth-building option because it harnesses the twin powers of Equity Buildup and Cash Flow Growth.